In many areas of the country, housing prices have screamed 20, 40, even 60% higher in the past 12 months. Peaking in April, communities have seen very low inventory and, in many cases, multiple buyers competing and escalating home prices to stratospheric heights.

Why did this happen? Can it continue? When will the bubble pop?

Let’s try to answer these 3 questions.

- Why did this happen? As in many things due to COVID, including lumber and semi-conductors, the stall in the supply chain led to deep shortages. In housing, the result of the pandemic is that there were 1,000,000 fewer real estate listings nationally than normal. People decided not to sell and not to move, so the inventory was very low. Add to that, the high cost of lumber and building costs increased while building permits decreased. Finally, the government instituted and foreclosure moratorium which even further restricted the supply of eligible homes on the market. So, low supply drove a higher demand which caused prices to rise quickly.

- Can it continue? In looking at the numbers, and according to the National Association of Realtors, the housing market has cooled noticeably since the peak in April. It is still a hot market, but the average listings is beginning to increase. Also, the banks and mortgage lenders are tightening their credit criteria significantly. This is causing less buyers eligible to buy, particularly in the Jumbo loan market. Finally, lumber prices have dropped back down to normal levels and building permits in many areas have increased back to normal levels.

- When will the bubble pop? As much as I would like to be Christian Bale in the Big Short, who knows if or when the real estate bubble will pop. Looking at statistics, it does appear that in the next 3 to 6 months, it is likely to pop, and it will be worse in some areas of the country than others. One key shoe left to drop is the foreclosure moratorium. With the recent Supreme Court ruling, we expect banks to begin foreclosing in the coming months, certainly by early 2022. More than 2.19 million homeowners missed their payment in June. Of course, all of these won’t be foreclosed on, but as soon as banks begin to force the issue, inventories will certainly rise.

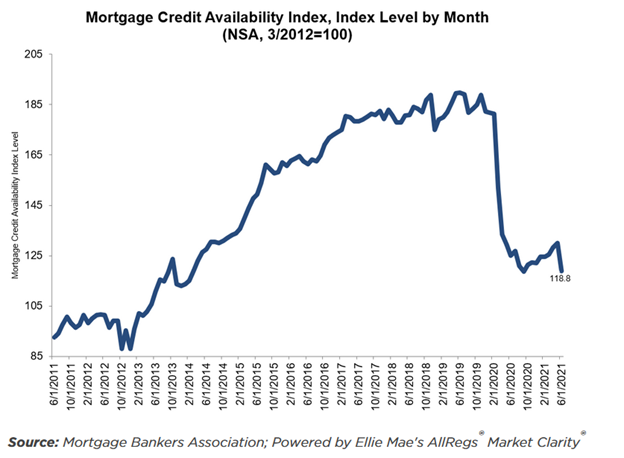

Looking at history, in 2008, we had historically high homeownership and a housing bubble that burst. In that case, the bubble was created by loose lending standards and having too many homeowners who were taking cash out of their equity and who really couldn’t afford the mortgages. While 2021 is slightly different, according to the Mortgage Availability index, mortgage credit has dropped to a 7 year low as seen below. As always, there are still home buyers and home sellers, but marketers will have to be much more selective and strategic moving forward and must keep a close eye on the housing statistics.