Mortgage rates have been on the rise lately. This has caused many mortgage companies to scale back on their marketing as they believe consumers are less likely to purchase a home in these conditions. While overall mortgage originations are down, consumers are still purchasing homes – they might just be more tricky to find.

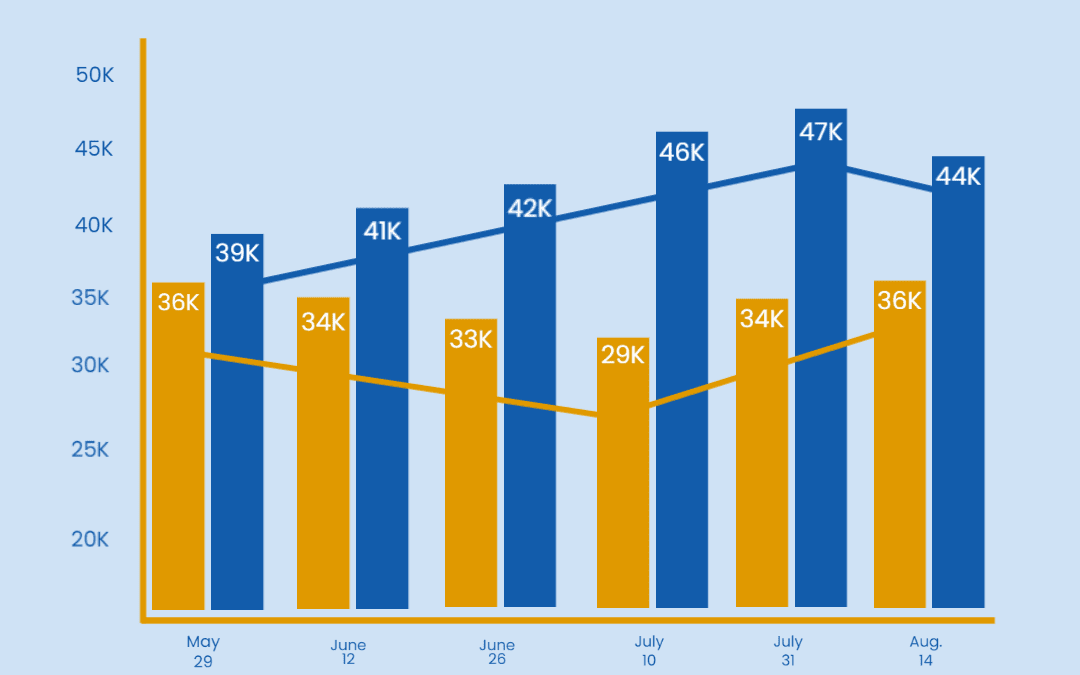

According to Altair’s Digital Shopping Indicators (DSI), which tracks the online web activity of millions of US consumers, the mortgage category specified for consumers looking for a new home has been steadily increasing over the last 3 months. This suggests that despite market conditions, consumers are still interested in purchasing a new home and are actively seeking mortgage products to do so.

While identifying consumers in the market to purchase a new home is somewhat akin to finding a needle in the haystack, tracking online web activity gives marketers an early indication that a consumer is interested and is statistically a better option than marketing to the masses.

The analysis shows that consumers who show up on the DSI dataset are more than twice as likely to submit a mortgage application. Of those that do submit a mortgage application, they do so within 27 days of showing up on the file.

This offers marketers a competitive advantage to nurture these consumers nearly a month before a traditional credit trigger. The ability to identify consumers early the sales funnel can be crucial as some consumers may not be as up to date on all the latest mortgage products that can help them afford a home.

While changes in the market can be difficult to navigate, it’s important that marketers are staying up to date on all the latest data trends to help identify consumers who are in the market for the products they offer. Altair is a trusted data provider for many of the nation’s leading financial institutions. Reach out to Altair’s team of strategists today to learn more on the latest audience targeting trends.