by Dave Hadaway | Dec 19, 2022 | Acquisition Marketing, Alternative Credit, Automotive Marketing, Campaign Measurement, Consumer Finance Marketing, Data and Analytics, Data Marketing Trends, Direct Marketing, Home Equity, Lead Generation, Mortgage Marketing, New Mover Marketing, Predictive Analytics, Prospect Data, Retail Marketing, Retention Marketing, Targeting and Segmentation

In the face of economic uncertainty, don’t sit idly by – strike back with these 6 digital marketing strategies to drive brand and business growth! It’s time for savvy marketers to double down on the fundamentals that will boost success. Follow these...

by Dave Hadaway | Dec 1, 2022 | Acquisition Marketing, Alternative Credit, Automotive Marketing, Campaign Measurement, Consumer Finance Marketing, Data and Analytics, Data Marketing Trends, Direct Marketing, Home Equity, Lead Generation, Mortgage Marketing, New Mover Marketing, Prospect Data, Retail Marketing, Retention Marketing, Targeting and Segmentation

Home Equity Lines of Credit on the Rise As interest rates continue to rise, many homeowners are looking for ways to tap into the equity they have in their homes. In the second quarter of this year, Americans took out $66 billion in home equity lines of credit...

by Dave Hadaway | Nov 9, 2022 | Acquisition Marketing, Alternative Credit, Data and Analytics, Data Marketing Trends, Direct Marketing, Lead Generation, Mortgage Marketing, New Mover Marketing, Predictive Analytics, Prospect Data

If you’re like most people, you probably think of the credit bureaus as three separate entities. And while it’s true that Experian, Equifax, and TransUnion all collect and maintain their own data, there are actually a number of benefits to working with all...

by Dave Hadaway | Sep 15, 2022 | Acquisition Marketing, Alternative Credit, Automotive Marketing, Campaign Measurement, Consumer Finance Marketing, Data and Analytics, Data Marketing Trends, Direct Marketing, Lead Generation, Mortgage Marketing, Predictive Analytics, Prospect Data, Targeting and Segmentation

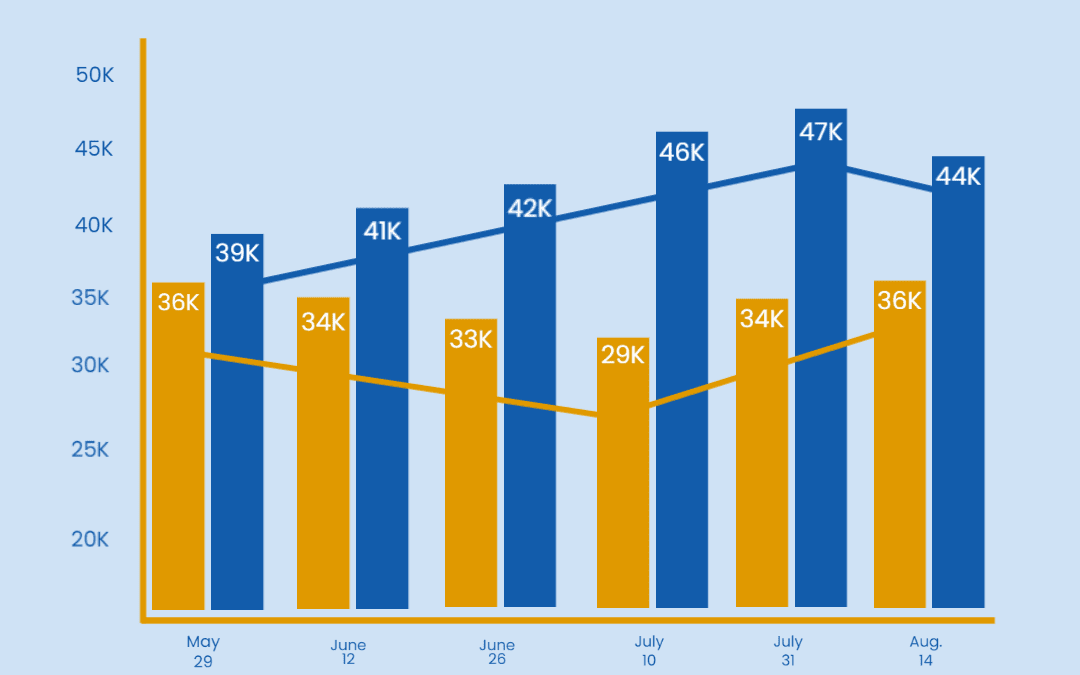

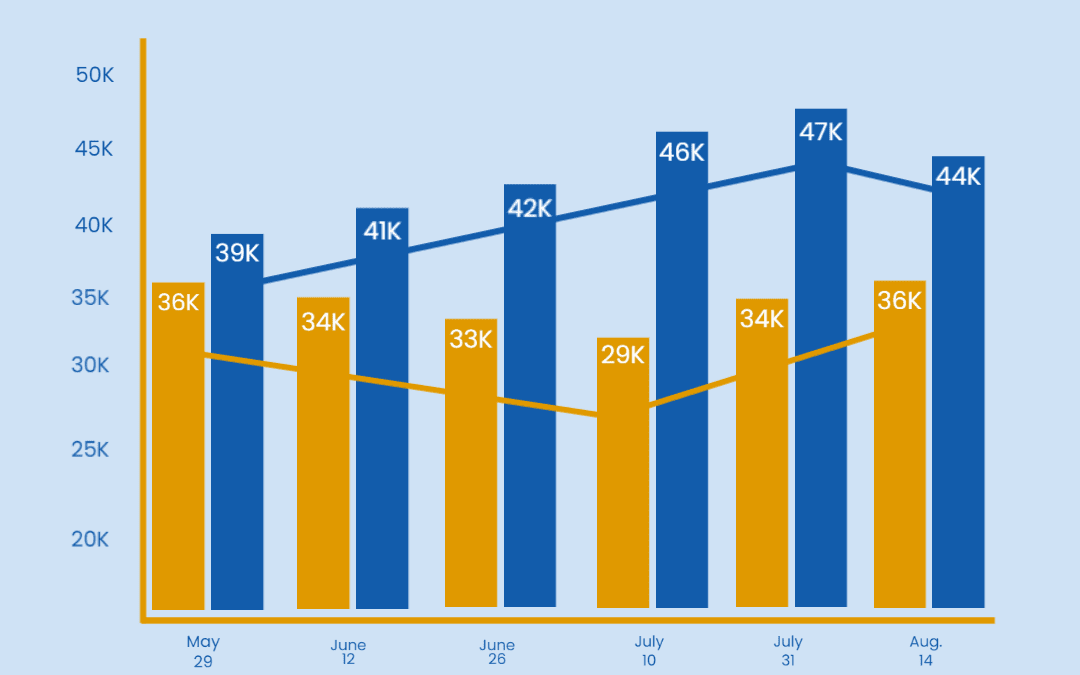

Mortgage rates have been on the rise lately. This has caused many mortgage companies to scale back on their marketing as they believe consumers are less likely to purchase a home in these conditions. While overall mortgage originations are down, consumers are still...

by Dave Hadaway | Sep 1, 2022 | Acquisition Marketing, Alternative Credit, Automotive Marketing, Campaign Measurement, Consumer Finance Marketing, Data Marketing Trends, New Mover Marketing, Predictive Analytics, Prospect Data, Targeting and Segmentation

As the finance industry becomes more complex, the need for data acumen becomes increasingly important. To make informed decisions, financial professionals need to be able to understand and analyze data. This requires not only technical expertise, but also a deep...

by Dave Hadaway | Aug 18, 2022 | Acquisition Marketing, Alternative Credit, Consumer Finance Marketing, Data and Analytics, Data Marketing Trends, Direct Marketing, Lead Generation, Mortgage Marketing, New Mover Marketing, Predictive Analytics, Prospect Data, Retention Marketing, Targeting and Segmentation

We all know at least one person who is seemingly bad with money. They’re always borrowing from you, always late on their bills, and always seem to be in a bad mood. You may have even wondered how they manage to stay afloat financially. The answer? Likely,...